Accept payment via apps or sell online? A 1099-K form may be in your future.

Changes to tax laws can cause stress and anxiety —whether you’ve been a business owner for years or you’re new on the block. If you receive payments or sell via online platforms like Etsy, eBay, or Venmo, a recent change may mean you’ll receive a tax form and hear about reporting requirements you may not be familiar with. That is, a Form 1099K.

For calendar year 2024, if your company received payments of $5,000 or more through one or more of these kinds of payment platforms, you will receive a tax form (called “Form 1099-K: Payment Card and Third-Party Network Transactions”) in January 2025 that impacts your business taxes.

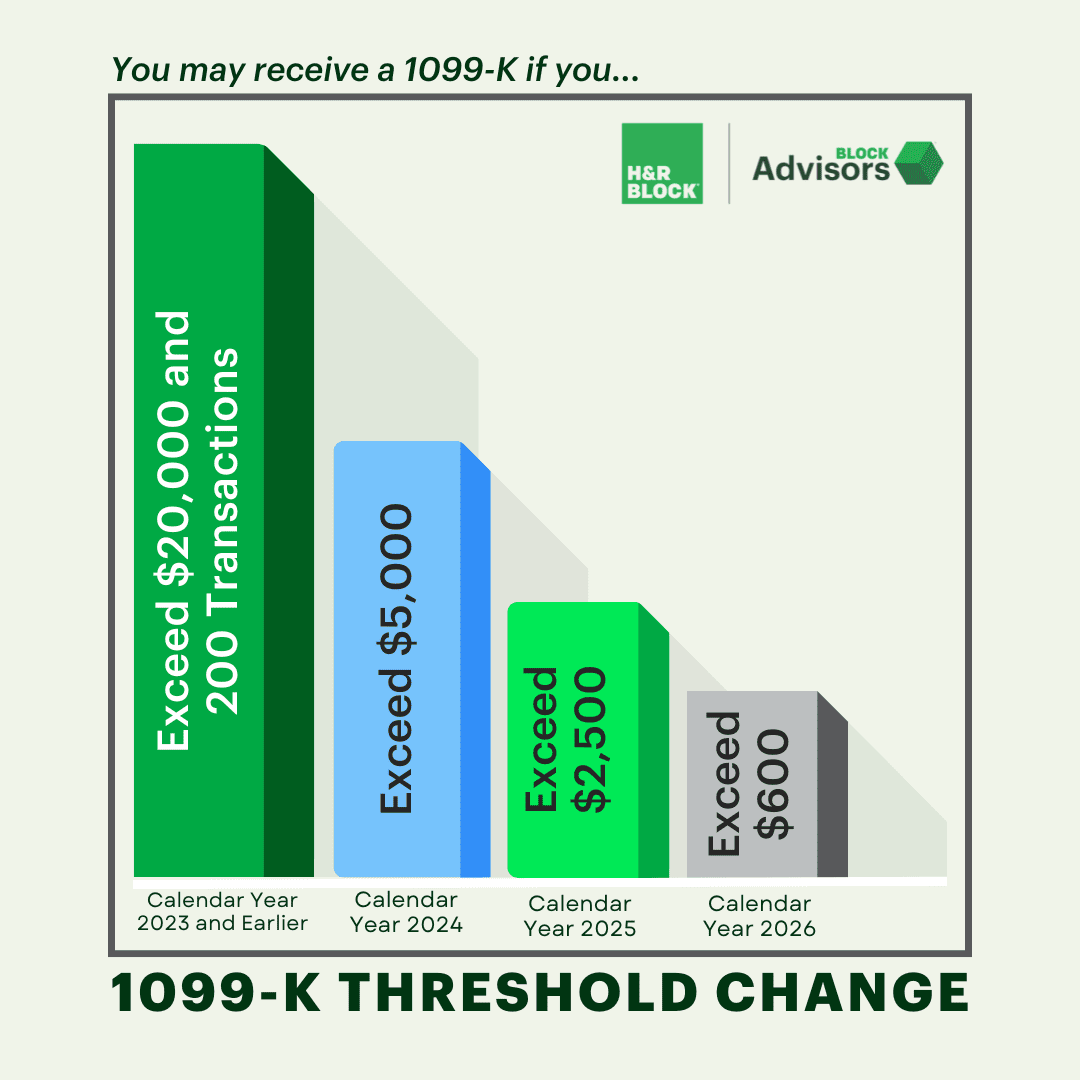

NOTE: Originally, the threshold for third-party payors to issue Form 1099-K was over $20,000 in payments and more than 200 transactions. A 2021 tax law decreased the threshold to over $600 in payments for any number of transactions. Under IRS transition guidance, the previous thresholds remained in place for tax years 2022 and 2023. Under new guidance released in November 2024, the threshold for calendar year 2024 will be payments over $5,000. In calendar year 2025, the threshold will be $2,500. Starting in calendar year 2026, the $600 threshold will go into effect.

Get help today and at tax time from the tax experts

Want to discuss how these recent tax changes may impact your small business? Block Advisors is here for you. Make an appointment today with a Certified Small Business Tax Pro who can help you navigate Form 1099-K and prepare for the upcoming tax season.

To learn more about 1099-K changes, read on!

Selling online and taxes: What you should know

What’s changed – The new laws significantly lower the previous threshold to receive the 1099K tax form. From $20,000 in gross payments and 200 transactions to just $5,000 and a single transaction for calendar year 2024.*

Who is affected – Any business receiving over $5,000 of income from PayPal, eBay, Venmo, Square, Facebook Pay, or other third-party apps or online sites. These groups are also known as TPSOs – Third-Party Settlement Organizations.

What you can do now – If you accept personal and business payments on the same account, your bookkeeping may be more complicated at tax time. Consider getting separate accounts to reduce the confusion. Block Advisors Bookkeeping Services are also available to help you navigate 1099-K changes and prepare for the tax season.

The impact – Although these changes could result in more paperwork for your business, they do not necessarily increase how much your company owes at tax time. Simply put, Form 1099-K is another tool to help ensure your tax return is accurate.

*The new Form 1099-K thresholds are part of changes from the American Rescue Plan Act passed in March 2021.

Digital Business Payment and Seller FAQs

I’ve never heard of a 1099-K. What is a 1099-K form?

Form 1099-K is an IRS form that shows money received from certain third-party sites, such as payment apps, digital marketplaces, or other credit or debit card processing sites. If your business earnings meet the reporting threshold, the apps or sites you use will issue the 1099-K by January 31. If you receive an eBay 1099K, Venmo 1099K, PayPal 1099K, or other Third-Party Settlement Organization (TPSO) 1099K, the recent threshold change to the form (mentioned above) may be why.

If you are an individual and not a business, check out H&R Block’s article on receiving money via apps or selling items online!

The platform I used asked me to fill out a W-9. Why is that?

The W-9 form is used to get an official record of your tax ID number or Employer Identification Number (EIN). If the app or online site you use is required to send you a 1099-K, they must have documentation of your tax ID/EIN on Form W-9. This is generally the case for all TPSOs, whether it is PayPal, eBay, Venmo, Square, or another similar site.

Do I have to pay tax on the amount that will be reported on the 1099-K? What if I expect a 1099-NEC for the same business income – do I need to report both?

If you accept payment for your business’s goods and services through third-party apps and online services (such as Square, PayPal, Venmo, eBay, etc.), you may receive a 1099-K AND a 1099-NEC. However, you don’t have to report the same business income twice.

You should report all business income on your tax return. All income, regardless of whether it is listed on a 1099-K, a 1099-NEC, or both, or not reported on any information document, must be reported to the IRS. The IRS requires you to file a tax return if you have $400 or more in net self-employment earnings.

NOTE: Paying a friend back for dinner or chipping in for a group gift to celebrate your dad’s 60th birthday? You won’t owe taxes for money transferred for personal use and reported on a 1099-K, but you may have to file some paperwork.

How can I get ready for my business tax filing? What do I need to do now?

When preparing for tax season, keep thorough records of the sales transactions you’ve made during the year for your business. Consider working with a bookkeeper to put you on the path to success. Also, keeping your personal and business payments on separate accounts will make your life much easier!

Should I start a Sole Proprietorship or LLC? Will that impact my taxes?

If you operate a business independently and haven’t formed a business entity such as an LLC or corporation, the IRS considers you a sole proprietorship by default. You may be considered a partnership if you work with one or more other individuals.

You can decide whether this is the best classification for your situation or whether you should consider forming another type of entity, such as an LLC. Make sure you understand the tax impacts of forming a business entity. Consider consulting an attorney for any questions about legal business entities.

Learn more about LLC vs. Sole Proprietorship.

Does the gross amount shown on a 1099-K need to match the total amount in Schedule C when filing my taxes?

For business sales on eBay, Etsy, Venmo, Square, and any other similar third-party settlement organization, you report the amount on Form 1099-K as revenue on your business return.

For example, if you are a sole proprietor, you will report the total amount from boxes 1a and 1b of every 1099-K you receive on line 1 of Schedule C within Form 1040. You will deduct any expenses you had from selling on the appropriate line of Schedule C. If your business expenses are more than your business income, you may be able to deduct the operating loss.

Should I get a separate bank account or credit card for my business?

Yes, you should consider getting a separate bank account and/or credit card to help keep business and sales transactions separate from your personal ones. This will make things easier come tax time since the business and sales transactions (and related business expenses) need to be tracked and reported separately.

I’m a new business owner – how will these changes impact my taxes?

You’ll have a few new tax considerations when you start a business. This includes making estimated tax payments and filing Schedule C.

Sound daunting? Don’t fret! Block Advisors, a part of H&R Block, has the expertise to cover all your small business tax needs.

Learn more about Block Advisors’ small business tax services.

Need assistance with Form 1099-K?

Block Advisors Small Business Certified Tax Pros are here to help.